How to Measure Agile Transformation ROI in Banking: Complete Guide

How Banks Measure Agile Transformation ROI?

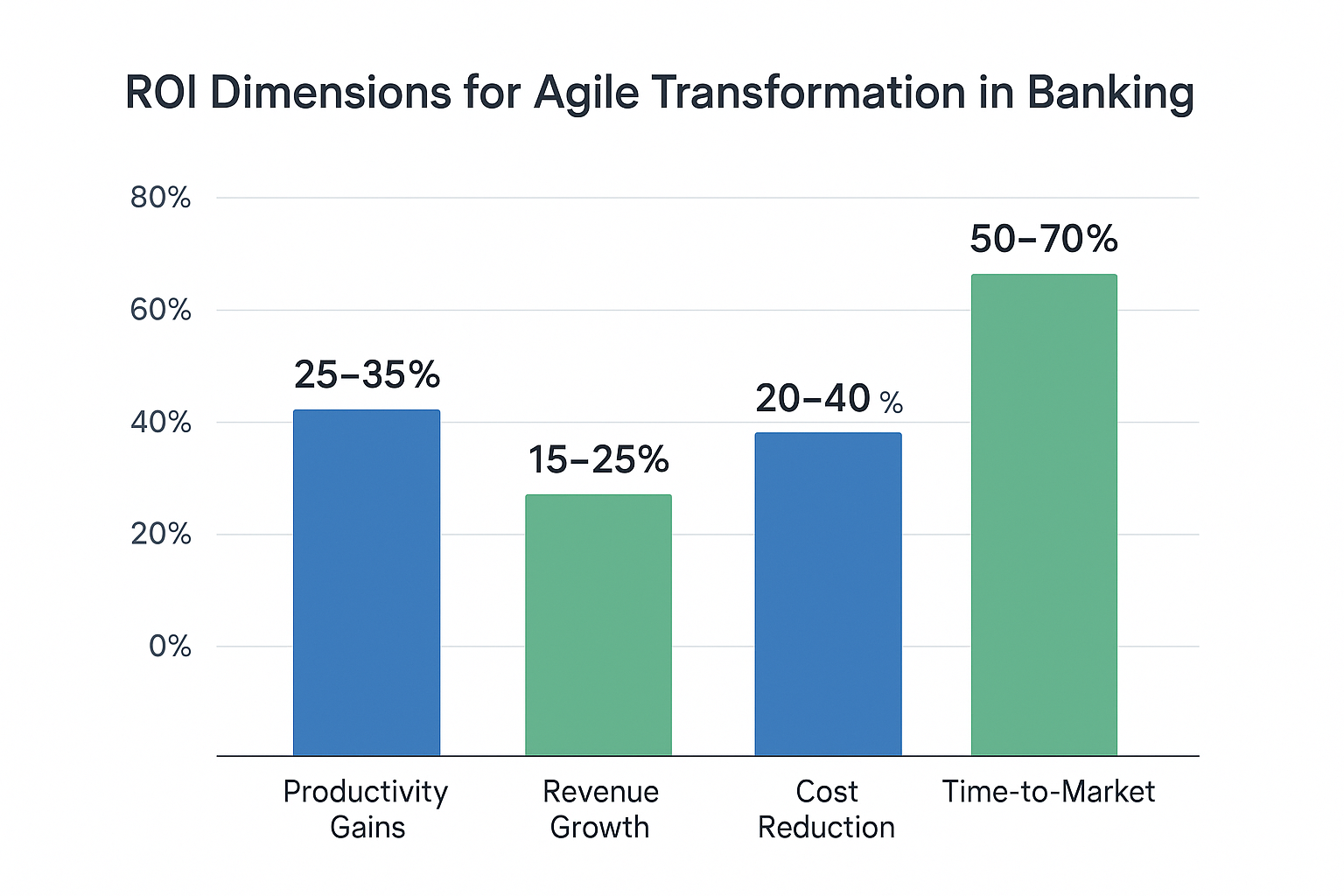

Banks measure agile transformation ROI through four critical dimensions: productivity gains (typically 25-35%), revenue acceleration (15-25% growth), cost reduction (20-40% in operational expenses), and time-to-market improvements (50-70% faster delivery cycles). Leading financial institutions track these metrics using balanced scorecards that combine financial indicators with operational performance measures, customer satisfaction scores, and employee engagement metrics.

The most successful banks establish baseline measurements before transformation begins, then monitor progress through quarterly business reviews using both leading indicators (team velocity, cycle time) and lagging indicators (revenue growth, customer satisfaction). This comprehensive approach enables institutions like Global Systemically Important Bank to achieve productivity increases of up to 25% while Bank of America generated 22% digital sales growth through their agile transformation initiatives.

Why Measuring Agile Transformation ROI Matters More Than Ever

Banking executives face an unprecedented challenge in today’s market. Customer expectations evolve at lightning speed while regulatory demands intensify and fintech competitors threaten market share daily. Yet leading financial institutions are turning this pressure into profit through strategic agile transformation.

For C-level executives, VPs, and senior directors in financial services, the question isn’t whether agile transformation delivers ROI. It’s how to measure, maximize, and sustain those returns while navigating complex regulatory requirements and legacy system constraints.

The Four-Dimensional ROI Framework for Banking

Successful banks measure agile transformation ROI across four interconnected dimensions that directly impact their bottom line and competitive positioning.

1. Productivity Gains: The Immediate Impact Multiplier

Productivity improvements represent the most immediate and measurable benefit of agile transformation. A 2025 market research shows that a payments business recorded a 30-35% productivity increase after implementing agile ways of working combined with process simplification and automation across front and middle-office operations.

Key Productivity Metrics:

- Cycle time reduction for critical processes

- Throughput increase in key workflows

- Resource utilization rates across teams

- Defect rates and rework percentages

- Automation adoption and impact

2. Revenue Acceleration: Creating New Value Pools

Revenue acceleration emerges as equally compelling evidence of transformation success. The same payments business that achieved dramatic productivity improvements also generated an additional $300 million in annual revenue, demonstrating that agile transformation creates new value pools rather than simply cutting costs.

Revenue Growth Indicators:

- New product revenue within 12 months of launch

- Digital channel adoption and transaction growth

- Customer lifetime value improvements

- Cross-selling and upselling success rates

- Market share gains in key segments

3. Strategic Cost Rebalancing: From Maintenance to Growth

Boston Consulting Group’s 2025 research reveals that by simplifying operations and scaling agile practices, banks can reduce run-the-bank costs enough to allocate over half of their IT budgets to growth-oriented projects. Traditional banks often find 70-80% of their IT spending trapped in maintenance and compliance activities.

Cost Rebalancing Metrics:

- Percentage of IT budget allocated to innovation vs. maintenance

- Legacy system modernization progress

- Operational process simplification

- Automation rate for routine tasks

- Third-party vendor consolidation savings

4. Speed and Agility: Market Responsiveness Advantage

A market analysis of a global systemically important bank found that switching from Waterfall to agile methodologies reduced time-to-market by approximately 60%. This speed advantage enables banks to capture first-mover advantages and respond to market disruptions before competitors.

Speed and Agility Metrics:

- Time-to-market for new products and features

- Regulatory compliance response time

- Customer request resolution speed

- Feature deployment frequency

- Market opportunity capture rate

ROI Measurement Framework

| ROI Dimension | Typical Impact Range | Primary Measurement | Strategic Value |

|---|---|---|---|

| Productivity Gains | 25-35% | Cycle time reduction, throughput increase | Foundation for other improvements |

| Revenue Growth | 15-25% | New product revenue, digital channel growth | Direct bottom-line impact |

| Cost Reduction | 20-40% | Operational expenses, error-related costs | Capital reallocation opportunity |

| Time-to-Market | 50-70% | Product launch cycles, feature deployment | Competitive advantage creation |

Real-World Success Stories: Proven ROI in Action

Bank of America: Digital-First Agile Implementation

Through agile methodologies, Bank of America continuously improved their digital banking experience and launched Erica, their AI-powered virtual assistant. The bank added 3 million new active digital users in a single year, bringing their total to 56 million. Digital sales grew 22%, approaching 50% of all consumer sales, while Erica surpassed 1 billion cumulative interactions.

Strategic Advantages Created:

- Faster response to customer needs and market changes

- Reduced operational costs through digital channel migration

- Enhanced customer experience leading to higher satisfaction scores

- Competitive differentiation through AI-powered services

Global Systemically Important Bank: Speed-to-Market Revolution

The institution switched from traditional Waterfall approaches to agile methodologies for IT development across critical systems. This change required significant cultural shifts and process redesign while maintaining regulatory compliance.

Dramatic Speed Improvements: Time-to-market fell by approximately 60%, productivity increased up to 25%, and agile projects were three times more likely to succeed compared to traditional Waterfall approaches. These improvements compounded over time as teams became more proficient with agile practices.

Banking-Specific Implementation Challenges and Solutions

Banking presents unique challenges for agile transformation that require specialized approaches.

Regulatory Compliance Integration Strategy

The biggest concern for banking executives is maintaining regulatory compliance while increasing development speed. Leading banks embed compliance considerations into their agile ceremonies and deliverable definitions rather than treating compliance as an afterthought.

Implementation Approach:

- Compliance officers participate in sprint planning and retrospectives

- Regulatory requirements are translated into acceptance criteria for user stories

- Automated compliance testing is integrated into continuous integration pipelines

- Regular compliance reviews are built into sprint cycles rather than project gates

Legacy System Modernization Without Disruption

Successful banks adopt strangler fig patterns and microservices architectures that allow incremental replacement of monolithic systems while maintaining operational stability. This approach enables continuous improvement without the risk of system-wide failures.

Key Implementation Tactics:

- Identify discrete business functions that can be extracted from legacy systems

- Build new microservices that replicate legacy functionality with modern architecture

- Gradually redirect traffic from legacy systems to new services

- Maintain parallel systems during transition periods to ensure stability

Risk Management Evolution: From Prevention to Detection

Banks implementing agile successfully invest heavily in monitoring, observability, and automated testing to maintain risk controls while enabling rapid iteration. This cultural shift requires developing an agile mindset focused on delivering customer value rather than simply following processes.

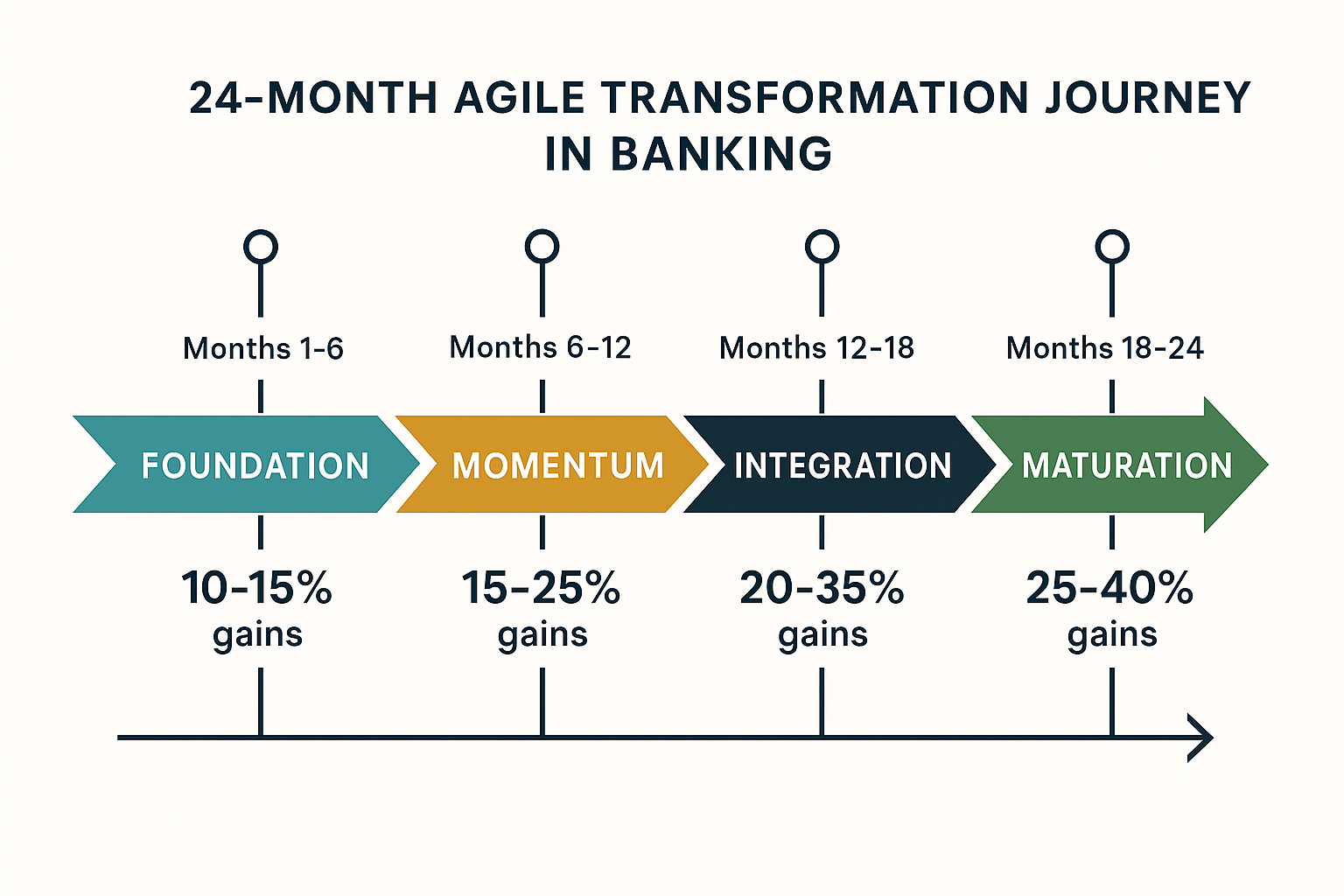

Agile Transformation Timeline: What to Expect When

Understanding realistic timelines helps banking executives set appropriate expectations and maintain stakeholder support throughout the journey.

Months 1-6: Foundation and Early Wins

- 10-15% improvement in pilot team productivity

- Reduced cycle times for specific processes

- Improved team satisfaction and engagement scores

- Early customer feedback improvements

Months 6-12: Momentum Building

- 15-25% productivity improvements across pilot areas

- Measurable customer satisfaction improvements

- Reduced operational costs in transformed areas

- Faster response times to customer requests and market changes

Months 12-18: Enterprise Integration

- 20-35% productivity gains across transformed areas

- Significant revenue growth from faster product launches

- Substantial cost reductions through process optimization

- Market share gains and competitive differentiation

Months 18-24: Maturation and Optimization

- 25-40% sustained productivity improvements

- Significant revenue growth from enhanced market responsiveness

- Major cost structure improvements and budget reallocation

- Industry leadership in customer experience and innovation

Agile transformation - Frequently Asked Questions

What are the key metrics for measuring agile transformation success in banking?

The most effective measurement approach combines financial metrics (revenue growth, cost reduction, ROI calculations), operational metrics (cycle time reduction, productivity improvements, quality improvements), customer experience metrics (Net Promoter Score, digital adoption rates, customer lifetime value), and employee engagement metrics (satisfaction surveys, retention rates, skills development measures).

How long does agile transformation typically take in banking?

Agile transformation in banking typically follows an 18-24 month timeline for full maturation, though early benefits become visible within 3-6 months. The timeline varies based on organizational size, complexity, and transformation scope, with factors like strong executive leadership and investment in training accelerating the process.

What are the biggest challenges of agile transformation in banking?

The primary challenges include regulatory compliance integration (maintaining compliance while increasing speed), legacy system modernization (updating decades-old systems without disruption), cultural resistance (shifting from risk-averse to experimental mindsets), and risk management evolution (moving from prevention-focused to detection and response-focused approaches).

How do you calculate ROI for agile transformation in financial institutions?

ROI calculation requires a comprehensive approach: ROI = (Financial Benefits - Transformation Costs) / Transformation Costs × 100. Financial benefits include revenue increases, cost reductions, operational savings, and IT budget reallocation value. Transformation costs include training investments, technology infrastructure, consulting expenses, and temporary productivity reductions.

What makes agile transformation successful in highly regulated industries like banking?

Success requires embedding compliance requirements into user story definitions, including regulatory experts as permanent team members, implementing automated compliance testing, establishing regular compliance reviews as part of sprint cycles, shifting to detection and response-focused risk management, and ensuring leadership commitment to both agile principles and regulatory compliance.

Strategic Implementation Framework for Banking Leaders

Achieving sustainable ROI requires a strategic approach addressing both technical and cultural dimensions. Leadership alignment represents the critical success factor, requiring executives to articulate the business case, allocate necessary resources, actively participate in agile ceremonies, and communicate transformation progress consistently.

Cross-functional team formation breaks down traditional silos by bringing together business analysts, developers, risk managers, and compliance specialists. This structure enables faster problem-solving and reduces communication overhead that typically plagues matrix organizations.

Continuous measurement and adaptation ensure that agile practices evolve with organizational needs. Banks should establish regular retrospectives at team, program, executive, and enterprise levels to enable course-correction when practices aren’t delivering expected results.

Expert Guidance for Transformation Success

Implementing comprehensive agile transformation in banking requires specialized expertise that combines deep understanding of financial services regulations, agile methodologies, and organizational change management. The most successful banking transformations benefit from expert guidance that addresses both technical implementation and cultural change requirements.

Organizations seeking to enhance their transformation capabilities often benefit from comprehensive business transformation consulting that provides integrated expertise across agile methodologies, regulatory compliance, and organizational change management. This specialized support enables banks to achieve transformation objectives while maintaining operational stability and regulatory adherence.

Conclusion: The Imperative for Action

The data is clear: banks that commit to comprehensive agile transformation see substantial, measurable returns across productivity, revenue, cost management, and strategic capability dimensions. Leading institutions report productivity gains of 30-35%, additional annual revenue of $300 million, and the ability to redirect over half of their IT budgets from maintenance to growth-oriented projects.

Success requires more than adopting agile ceremonies or restructuring teams. It demands fundamental changes in how banks think about value creation, risk management, and customer engagement. For organizations ready to make this commitment, the potential returns, measured in hundreds of millions of dollars and sustained competitive advantage, justify the investment and effort required.

The window for competitive advantage through agile transformation is narrowing as more banks recognize its importance. Organizations that act decisively and implement comprehensive transformation strategies will create lasting advantages in an increasingly competitive and rapidly changing banking environment.

Questions? We Can Help.

When you’re ready to move beyond piecemeal resources and take your Agile skills or transformation efforts to the next level, get personalized support from the world’s leaders in agility.